Lets talk about Drivers Insurance Quote. Drivers Insurance its also known as automobile insurance is for fixing your car, covering medical bills for you or others people in case of an accident & paying for damage you may have caused to someone else’s property. You make a deal with insurance company when you get driver’s insurance which is also known as auto insurance. You pay them a fee every month & if you’re in a car accident they agree to help pay for any damage or injuries you cause. The “quote” is just their best guess at how much you’ll have to pay based on things like your car and how you’ve driven in the past.

What does a driver’s insurance quote mean?

An estimate of the cost of motor insurance based on your driving history and personal data is called a driver’s insurance quotation. Not everyone will find your quotation to be the same. Your age, driving record, vehicle type, residence, and in certain places, even your credit score, are all factors that affect it.

Obtaining quotes from many providers enables you to evaluate costs, identify discounts, and select the coverage that best suits your needs and financial situation.

The Significance of Obtaining a Quote

If you don’t compare quotes, you’ll never know if you’re already receiving a good value on your insurance. Here’s why getting a quotation for auto insurance is so crucial:

- Save Money: By comparing quotations, you may find better prices or undiscovered discounts.

- Tailored Coverage: Quotes let you weigh your alternatives and avoid paying too much for unnecessary coverage.

- Understand Your Risk Factors: Find out how your car model or driving history impacts your premium.

- Prevent Surprises: Before you commit, a quotation details your coverage.

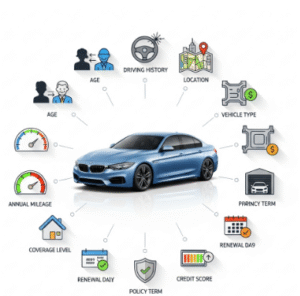

What Influences Your Quote for Auto Insurance?

Insurers take into account a number of factors when you request a quote. These are the principal ones:

- Driving History: Tickets, accidents, or DUIs may raise your rate.

- Location: Rates are typically higher in urban areas than in rural ones.

- Experience & Age: Newer or younger drivers frequently earn more.

- Vehicle Type: Insurance rates for luxury and sports cars are higher.

- Level of Coverage: Higher premiums correspond to more coverage.

- Credit Score: In certain states, your rate is influenced by your credit history.

How to Get the Best Quote for Auto Insurance

Are you looking for a quote that fits your budget? Try these suggestions:

- Don’t accept the first offer; compare at least three companies.

- Bundle Your Policies: To save even more money, combine your renters’, homeowners’, and auto insurance.

- Inquire About Discounts: You might be eligible for student, low-mileage, or safe driver discounts.

- Raise Your Deductible: You can reduce your monthly premium by raising your deductible.

- Review Every Year Every year, your needs and driving style may evolve.

Where to Find a Trustworthy Estimate

Major insurance companies like GEICO, State Farm, Allstate, Progressive, and Liberty Mutual are available to provide quotes directly to you. Additionally, you can use comparison websites such as:

- The Zebra

- The NerdWallet

- Comparative.com

- Policygenius

These websites make it simple to enter your information once and get several quotes displayed side by side.

Concluding remarks

My friend, you might be spending hundreds more than you need to every year if you drive without comparing prices. The good news is that you can save a lot of money by obtaining a driver’s insurance quote quickly and for free. Hi Reader, it only takes a few clicks to get your next cheap auto insurance policy.

Take a moment, get a quote, and drive with assurance knowing that you’re protected without going over budget.

Common FAQs

1. What is a driver’s insurance quote?

It’s an estimate of how much you’ll pay for car insurance, based on your personal and driving info.

2. Is getting a quote free?

Yes! Most insurance companies and comparison sites offer quotes for free — no strings attached.

3. Will getting a quote affect my credit or insurance rates?

Nope! Getting a quote is safe and won’t impact your credit score or current policy.

4. How long does it take to get a quote?

Usually just 5–10 minutes online — faster if you have your info ready!

5. What do I need to get a quote?

You’ll need your driver’s license, vehicle info, and driving history.

6. Can I get quotes from more than one company?

Yes, and you should! Comparing at least 3 quotes can help you find the best deal.

7. Why are my quotes so different between companies?

Each insurer uses different formulas and risk factors — that’s why prices vary.

8. Can I buy insurance right after getting a quote?

Absolutely! Most sites let you buy instantly if you like the offer.

9. Will my quote change later?

It might. If details are missing or incorrect, the final rate could be higher or lower.

10. How often should I check for new quotes?

At least once a year — or anytime your situation changes (like a new car or address).