Commercial auto insurance, which protects against liability, damage, and accidents, covers business vehicles and helps businesses run efficiently.

Commercial auto insurance: what is it?

A specific kind of coverage intended to safeguard automobiles used for business is commercial auto insurance. It provides more comprehensive coverage for company-owned automobiles, trucks, vans, and other vehicles against collisions, property damage, theft, and liability claims than personal auto insurance. Whether you run a huge fleet of commercial trucks or a tiny firm with a single delivery van, this insurance protects your operations against expensive financial setbacks. Businesses that own automobiles are required by law to do so in the majority of states, guaranteeing security and compliance. Business owners may safeguard their assets, staff, and overall company stability by making educated decisions based on their knowledge of commercial vehicle insurance and how it operates.

Commercial Auto Insurance: Who Needs It?

This coverage should be taken into consideration by every company that uses cars for work-related activities. Among the examples are:

- Delivery Services: e-commerce delivery fleets, food delivery companies, and couriers.

- Trucks used in construction and contracting are used to move heavy machinery, supplies, and tools.

- Agents that drive to client meetings and property locations are real estate and sales professionals.

- Long-distance truckers and cargo carriers are examples of transport and logistics.

- Service-based companies include cleaning services, plumbers, electricians, and more.

A commercial policy is necessary because your standard personal auto policy might not cover business-related incidents, even if you use your personal vehicle for work.

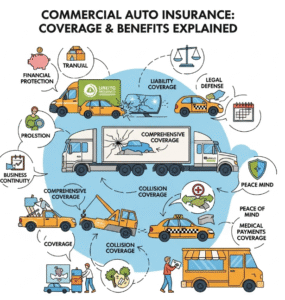

Important Commercial Auto Insurance Coverages

Typical choices for coverage include:

1. Coverage for Liability

This covers any property damage and personal harm that other people may sustain in an accident involving your company car.

2. Coverage for Collisions

covers the cost of replacing or repairing your company car in the event of an accident, regardless of who is at fault.

3. Thorough Coverage

protects against damages that are not caused by collisions, such theft, fire, vandalism, or natural catastrophes.

4. Coverage for Uninsured/Underinsured Drivers

covers your costs in the event that a motorist without enough insurance strikes your business vehicle.

5. Coverage for Medical Payments

helps pay for your passengers’ and your own medical bills following an accident, regardless of who is at fault.

6. Equipment or Cargo Coverage:

An optional addition for companies that move tools, specific equipment, or merchandise.

Advantages of Business Auto Insurance

- Legal Compliance: Follows all state and federal rules for commercial vehicle insurance.

- Financial Protection: Keeps your firm from having to pay for all of the repairs, litigation, or medical expenses.

- Employee Coverage: This protects workers who drive your cars for work.

- Customizable Options: Policies may be made to fit the demands of a certain industry.

- Peace of Mind : lets you focus on growing your business without worrying about accidents all the time.

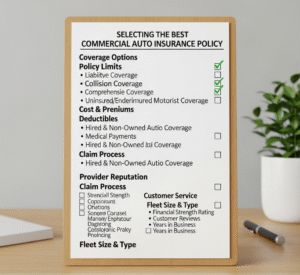

Factors Influencing the Cost of Commercial Auto Insurance

A number of variables affect how much commercial vehicle insurance costs:

- Type of Vehicle: Insurance rates are often higher for larger and more costly automobiles.

- Industry Type: Insurance rates may be higher for high-risk sectors like transportation.

- Driving History: While accidents raise costs, clean driving records reduce them.

- Coverage Limits: Although they come with higher rates, greater limits provide better protection.

- Location: The state and location in which your company operates have an impact on insurance premiums.

- Vehicle Usage: The frequency and distance of travel of your company vehicles affects expenses.

Choosing the Best Commercial Auto Insurance: Some Advice

- Evaluate Your Needs: Determine the hazards associated with the way your cars are used.

- Compare Several Quotes: Insurers’ rates might differ greatly from one another.

- Look for policies that are specific to your industry: Certain insurers provide coverage according to the nature of your company.

- Verify your coverage’s capacity to manage future high claims by reviewing your liability limits.

- Combine with Other Business Insurance: You can save money by combining insurance.

- Recognize Exclusions: To prevent surprises, be aware of what is not covered.

Common Errors to Steer Clear of

- Using personal auto insurance: Most business-related incidents are not covered by it.

- Selecting Minimum Coverage might not be sufficient in cases of severe incidents.

- Ignoring Policy Details: Claims may go undiscovered if exclusions are neglected.

- Not Updating Your Policy: If you add drivers or cars without telling your insurer, your coverage may be nullified.

The Reasons Commercial Auto Insurance Makes Sense

Business automobiles are important resources and necessary equipment for daily tasks. The cost of repairs, legal expenses, and missed productivity from a single accident can reach thousands of dollars. Commercial vehicle insurance makes sure that these kinds of accidents don’t jeopardize the financial viability of your business. It is a strategic safety net that enables companies to function with confidence in a cutthroat market, not merely a legal need.

In conclusion

An essential component of every company that employs cars for work is commercial auto insurance. It provides a wide range of advantages that protect your business, from financial stability and regulatory compliance to safeguarding personnel and property. You can make sure your company is robust to hazards associated with the road by knowing what you need, weighing your alternatives, and investing in sufficient coverage. The correct insurance coverage isn’t only a formality in the fast-paced world of business; it’s your company’s road safety net.

10 Short FAQs on Commercial Auto Insurance

- Does it cover employees driving the vehicle?

Sure, as long as their insurance allows them to drive. - Can I substitute my personal insurance?

No, personal auto insurance often excludes business use. - Does it cover rental vehicles for business?

Many policies offer optional coverage for rentals. - Does it cover theft?

Yes, under comprehensive coverage. - Can I insure multiple vehicles?

Yes, through a fleet insurance policy. - Is there a deductible?

Yes, the amount depends on your chosen policy. - How can I lower premiums?

Maintain a clean driving record and choose higher deductibles.