Let’s talk about Automobile Insurance Catagory Insurance, One kind of coverage that can help shield your finances in the event that your car is stolen, damaged, or involved in an accident is auto insurance. It falls under the category of auto insurance and can pay for repairs, property damage to third parties, injury-related medical bills, and even legal fees. Simply put, it serves as a safety net, preventing you from having to pay hefty sums of money in the event that your car experiences an unforeseen circumstance.

What is Automobile Insurance?

An agreement between you and an insurance company that provides financial security in the event that your car is damaged or you are in an accident is known as auto insurance. Having auto insurance in the USA is not only wise, but frequently mandated by law.

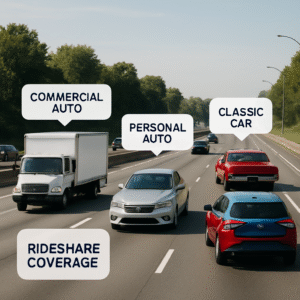

Types of Automobile Insurance Coverage

Not every policy is made equally. The primary kinds you should be aware of are as follows:

- Liability coverage pays for any harm or losses you inflict on other people in the event of an accident.

- Collision Coverage: Covers auto repairs following an accident, regardless of who is at fault.

- Complete Coverage: Offers protection against non-collision events such as natural disasters, theft, and vandalism.

- PIP, or personal injury protection, helps pay for your passengers’ and your own medical bills.

- If the other driver’s insurance is insufficient, you are protected by uninsured/underinsured motorist coverage.

How Automobile Insurance Works

You agree to pay a premium when you purchase an insurance policy; this premium may be paid monthly, quarterly, or annually. You could have to pay a deductible in the event of an incident before your insurer pays the remaining amount. Reporting the occurrence, presenting supporting documentation, and negotiating settlement with the insurance to pay for repairs or damages are typically steps in the claim procedure.

Factors That Affect Your Premium

There are a number of elements that affect your insurance rate, therefore it is not random:

- Driving Record: Lower premiums are typically associated with fewer collisions or infractions.

- Vehicle Type: Insurance rates for luxury or sports cars are frequently higher.

- Location: Rates may increase if you live in an area with a lot of traffic or theft.

- Credit Score: When determining rates, insurers in many states take your credit history into account.

Choosing the Right Policy

Determine how much coverage you truly need first. Examine estimates from several companies and look for extras like rental reimbursement or roadside help. Remember to search for savings; low-mileage benefits, bundled insurance, and safe driver rewards can all help you save money.

Common Mistakes to Avoid

- Choosing the least expensive policy could save you money up front, but it won’t cover you afterward.

- Ignoring Policy Details: Before signing, always read the fine print.

- Ignoring uninsured motorist coverage might be an expensive mistake if you are struck by an uninsured driver.

Benefits of Automobile Insurance

A good policy offers peace of mind in addition to legal compliance. After an accident, you’ll be shielded from litigation, compensated for expensive repairs, and comforted to know that assistance is only a phone call away.

Final Thoughts

Auto insurance is a safety net for one of your largest investments, not just a monthly expense. Spend some time investigating, contrasting, and selecting a plan that suits your spending limit and driving style. You can avoid serious headaches later by putting forth a little effort today.

FAQs

1. What is automobile insurance?

It’s a policy that protects you financially if your car is damaged or you cause an accident.

2. Is car insurance mandatory in the USA?

Yes, most states require at least basic liability coverage.

3. What does liability insurance cover?

It pays for injuries or damages you cause to others.

4. Do I need comprehensive coverage?

Yes, if you want protection from theft, vandalism, or natural disasters.

5. What’s the difference between collision and comprehensive?

Collision covers crash damage, while comprehensive covers non-crash events.

6. Can I lower my car insurance costs?

Yes—by driving safely, bundling policies, or raising your deductible.

7. Does my credit score affect my premium?

In many states, yes—better credit can mean lower rates.

8. What happens if I’m hit by an uninsured driver?

Uninsured motorist coverage can pay for your damages and medical bills.

9. How fast can I get car insurance?

Often within the same day—many insurers offer instant coverage online.

10. Is the cheapest policy always best?

Not always—low prices can mean less protection when you need it most.