Your property, car, and financial stability are safeguarded against unforeseen circumstances by Home And Auto Insurance Category. To assist you in selecting the best coverage for your need, this category includes information about plans, providers, and advice.

Home insurance: what is it?

The purpose of home insurance, also known as homeowners insurance, is to safeguard your house, personal property, and responsibility in the event of an accident or natural disaster. Usually, it includes:

- Damage to property resulting from natural catastrophes, theft, vandalism, or fire (based on the conditions of the policy)

- Personal items in the house, including clothing, gadgets, and furnishings

- liability coverage in the event that someone is hurt on your land

- Extra living costs in the event that covered damage forces you to temporarily relocate

This coverage is crucial for homeowners, and lenders frequently demand it for borrowers.

Auto insurance: what is it?

If your car is damaged or you injure someone else while driving, auto insurance will cover the costs. The primary categories of coverage consist of:

- Liability coverage: Covers other people’s property damage and injuries if you cause an accident.

- Regardless of who is at blame, collision coverage protects your own vehicle against damage sustained in an accident.

- Complete coverage: Guards against weather-related occurrences, theft, vandalism, and other non-collision situations.

- Coverage for uninsured or underinsured drivers protects you in the event that the other driver does not have enough insurance.

Most states have laws requiring auto insurance, and the type of coverage you require will depend on your region, driving record, and car’s worth.

Why Combine Auto and Home Insurance?

Bundling, or buying house and vehicle insurance from the same company, is one of the best methods to save money on both kinds of policy. Advantages consist of:

- savings: A lot of insurance companies provide 10%–25% multi-policy savings.

- Management made easier: For both insurance, there is just one point of contact, one bill, and one provider.

- Better customer relations: Policyholders who bundle frequently get loyalty benefits and priority assistance.

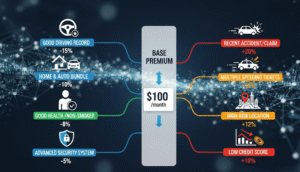

The Elements That Impact Your Premiums

Understanding the many elements that affect insurance costs may help you control your rates:

- Location: Premiums are often higher in areas with high crime rates or severe weather hazards.

- Credit score: A lot of insurers base their premiums and risk assessments on credit history.

- Claims history: A number of claims might result in a large increase in your premium.

- Limits on coverage: Higher coverage quantities translate into higher rates.

- A greater deductible often translates into cheaper premiums but higher out-of-pocket expenses in the event of a claim.

Ways to Reduce the Cost of Auto and Home Insurance

Take into consideration these tactics if you want to reduce your expenses without sacrificing coverage:

- Every year, compare prices from a minimum of three different insurance companies.

- Raising your deductible might help you save money on monthly premiums if you can afford a larger out-of-pocket payment.

- Preserve your credit: Better rates are frequently the consequence of a high credit score.

- Install safety features: Discounts may result from installing fire alarms, home security systems, and anti-theft equipment in automobiles.

- Bundle your policies: As previously said, this is one of the simplest methods to save money.

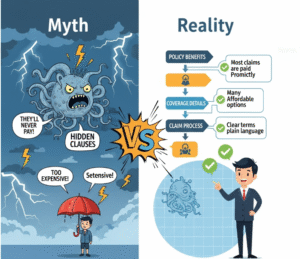

Typical Myths About Auto and Home Insurance

The way these regulations operate is often misunderstood. Let’s dispel a few widespread misconceptions:

- “All forms of damage are covered by home insurance.”

False; earthquakes and floods frequently need different coverage. - “The bare minimum of auto insurance is sufficient.”

Following a major accident, minimum criteria could not provide you with complete financial protection. - “My rates won’t be impacted by filing minor claims.”

Over time, even small claims may result in increased rates.

Selecting the Appropriate Insurance Company

Think about more than simply cost when choosing an insurer. Seek out:

- Verify financial soundness by looking at ratings from organizations such as A.M. Best.

- Customer service: Examine ratings for claim satisfaction and read reviews.

- Flexibility in coverage: Make sure you can modify your insurance as your needs evolve.

- Availability of discounts: Inquire about all possible ways to save money.

Insurance’s Function in Financial Planning

In addition to safeguarding assets, home and vehicle insurance are essential components of long-term financial planning. Your savings objectives might be derailed by out-of-pocket costs if you don’t have the right coverage. Sufficient insurance guarantees that an unforeseen circumstance won’t result in monetary difficulties.

Concluding remarks

To safeguard your most important assets—your home, your vehicle, and your financial security—home and auto insurance go hand in hand. You may obtain complete protection without going over budget by being aware of your coverage requirements, weighing your alternatives, and utilizing savings like bundling. It’s important to strike the correct balance between price and sufficient coverage; the cheapest insurance isn’t necessarily the best.

Frequently Asked Questions (FAQs)

1. What is home insurance?

Home insurance protects your property, belongings, and liability against covered risks like fire, theft, and certain natural disasters.

2. What does auto insurance cover?

Auto insurance covers vehicle damage, third-party liability, theft, and other risks depending on your policy type.

3. Is bundling home and auto insurance cheaper?

Yes, bundling can save 10%–25% on premiums with most insurers.

4. Do I need home insurance if my house is paid off?

It’s not required, but it’s highly recommended for financial protection.

5. How can I lower my auto insurance premium?

Maintain a clean driving record, increase your deductible, and install safety devices.

6. Does home insurance cover floods?

Typically, no — flood insurance is sold separately.

7. What factors affect my insurance rates?

Location, claims history, credit score, coverage limits, and deductibles.

8. Can I have multiple insurance policies with different providers?

Yes, but bundling with one provider can be more cost-effective.

9. Is auto insurance mandatory?

Yes, in most states, at least the minimum liability coverage is required.

10. How often should I review my insurance policies?

Review annually or after major life changes to ensure adequate coverage.