Hello there Lets talk about Insurance For Motorcycle. Most people like to ride motorcycle and they all want to ride freely without any kind of worry like birds fly in the sky and no one can touch them from the ground. We all know that maintaining bike can be bit expansive. If our bike faces any mechanical issue or our bike gets into an accident, it will cost a lot of money and it will be very difficult for us to meet those expenses. But with the help of the insurance you can meet those expanses and ride again freely without any worries. You simply have to find good insurance for your bike and you have to pay small amount monthly based on your insurance.

The Significance of Motorcycle Insurance

Although they are entertaining, motorcycles are dangerous. Bikes lack the same level of protection as vehicles, which increases the risk of accidents and raises the expense of repairs. In order to safeguard you, your bike, and other drivers, insurance comes into play.

Motorcycle insurance is also legally required in the majority of U.S. states in order to ride on public highways.

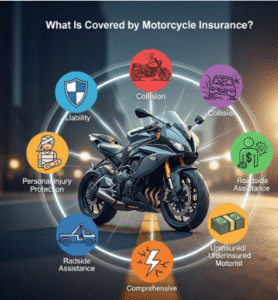

What Is Covered by Motorcycle Insurance?

Many different situations can be covered by a good motorbike insurance coverage. The most popular kinds of coverage are as follows:

- Liability insurance, which is necessary in the majority of states, covers harm or damages you cause to other people.

- Collision coverage: Covers your bike’s damage in the event of an accident.

- Full Coverage: Guards against weather damage, theft, vandalism, and collisions with animals.

- Medical Payments (MedPay): This helps you or your travel companion pay for medical expenses.

- Uninsured/Underinsured Motorist: This protects you in the event that you are struck by a driver who has little or no insurance.

- Accessories Coverage: Preserves upgrades, gear, helmets, and custom parts.

Depending on how frequently you ride and the type of bike you possess, you may select basic protection or create a full insurance.

How Much Does Insurance Cost for Motorcycles?

A few variables affect the price, including:

- Bike type: Sport motorcycles are more expensive to insure than scooters or cruisers.

- Experience & Age: New or younger riders may incur higher fees.

- Location: Premiums are greater in urban locations than in rural ones.

- Driving record: Higher rates are associated with accidents or citations.

- Coverage limits: Higher premiums are typically associated with more coverage.

Depending on your state and riding style, motorbike insurance typically costs between $200 and $1,000 or more year.

How to Find the Best Insurance for Motorcycles

Do you want to minimize costs without sacrificing quality? Here’s how:

- Examine a few of quotes before choosing one. Speak with an agent or use internet resources.

- Bundle Policies: For savings, combine with house or vehicle insurance.

- Find Out About Discounts: A lot of companies give discounts to customers who ride safely, finish a safety course, or keep their bikes in a garage.

- Modify Your Deductible: Generally speaking, a greater deductible results in a cheaper monthly cost.

Leading Providers of Motorcycle Insurance

Several well-known businesses that provide excellent motorbike insurance are:

- Progressive: Well-liked for its extensive customization and savings.

- GEICO is renowned for its affordable prices.

- Dairyland: Suitable for SR-22 or high-risk riders.

- Allstate: Provides comprehensive coverage for unique parts and accessories.

- Excellent choices for roadside help are available nationwide.

Concluding remarks

Motorcycle insurance, my friend, is about safeguarding your vehicle, your finances, and your life, not just about abiding by the law. Hey Friend, having the proper coverage provides you piece of mind every time you take the road because even the most experienced riders may encounter unforeseen circumstances. Hi Reader, you’ve made a sensible decision. Ride carefully, keep yourself covered, and enjoy the wide road.

Are you prepared to increase your coverage? Get the protection you deserve by comparing motorbike insurance rates right now.

Common FAQs

1. Do I really need motorcycle insurance?

Yes, friend! Most states require it, and it protects you and your bike from expensive accidents.

2. What’s the cheapest type of coverage?

Liability-only is the cheapest, but it won’t cover damage to your own bike.

3. Will my auto insurance cover my motorcycle?

Nope — motorcycles need their own separate policy.

4. Can I get insurance if I have a custom bike?

Yes! Just make sure to add accessory or custom parts coverage.

5. Are there discounts for motorcycle insurance?

Definitely! You can save by bundling, taking safety courses, or having a clean riding record.

6. What happens if someone steals my bike?

If you have comprehensive coverage, theft is usually covered.

7. Does insurance cover passengers?

Yes, if you include medical payments or guest passenger liability in your policy.

8. Is motorcycle insurance more expensive than car insurance?

It depends, but often it’s cheaper — especially for cruisers or scooters.

9. Can I pause my coverage in the winter?

Some insurers offer lay-up policies during the off-season. Just ask!

10. How do I get a quote fast?

Easy — go online, enter your info, and compare rates in minutes.